The Beginning of the End

An unholy combination of inflation and slowing growth tightens the noose around central bankers

Economic Developments

A Rock and a Hard Place (Part Deux):

In our last issue (Federal Reserve Tapering Implications - July 29, 2021), we noted that the Federal Reserve had become wedged between it’s dual mandate of price stability and maximum employment. Specifically, we noted that:

1) an unholy trifecta of asset price bubbles fueled by Federal Reserve asset purchases, inflation driven by fiscal stimulus and persistently high unemployment had formed;

2) failing to act to combat inflation increasingly comes into focus as a reflection on the Federal Reserve’s credibility because market participants begin to doubt the ability of the Federal Reserve to deploy it’s customary “tools” (mainly interest rate increases) without destroying the global debt markets; and

3) the Federal Reserve is left with a Hobson’s Choice, between (a) raising rates and/or tapering asset purchases, preventing inflation, but destroying the credit markets (particularly corporate credit and housing), damaging the co-dependent equity markets (stocks, housing prices, etc.) and increasing unemployment (as business fail or cut-back on workers); or (b) maintaining rates and/or asset purchases, protecting capital markets from default and keeping workers employed, but eroding the purchasing power of the US dollar.

As the months have progressed, we have begun to see these 3 observations unfold in real-time.

First, the Federal Reserve has chosen to continue not to act (instead hoping supply bottlenecks and labor shortages will spontaneously resolve and cause inflation to prove “transitory”). The Federal Reserve made this decision largely under the guise of a commitment to maximum employment (at the expense of price stability and in the face of significant labor shortages), yet the unemployment rate has remained largely stuck at ~5% (to be fair there was some modest improvement from 5.9% to ~4.8% since our last writing). Given this, it is our conclusion that the unemployment rate seems unlikely to be improved by the ultra-loose monetary policy of the Federal Reserve.

Second, in the face of inaction from those responsible for price stability, inflation has increased at a rapid clip (up to 5.4% year-over-year gain). Energy and food prices in particular have climbed dramatically (gasoline prices in particular rising by an annual increase of more than 40%, associated with fuel shortages globally). These price increases have caused a fair bit of strife among consumers with personal consumption growth coming in at a meager 1.6% in Q3 (down from the 12.0% in Q2). It is notable that personal consumption makes up the largest component of US GDP.

Third, growth has continued to stall with Q3 GDP gains measured at 2% (down markedly from Q2’s 6.7%) as a lack of additional government fiscal support, supply chain disruptions and massive global debt begin to push the US closer to a “double-dip” recession.

The combination of these factors puts the Federal Reserve and global markets in the worst of all possible worlds.

The Noose of Inflation Tightens:

The Federal Reserve is rapidly approaching the point at which any decision will yield a negative result. To quote Niccolo Machiavelli, “there is no avoiding war; it can only be postponed to the advantage of others.”

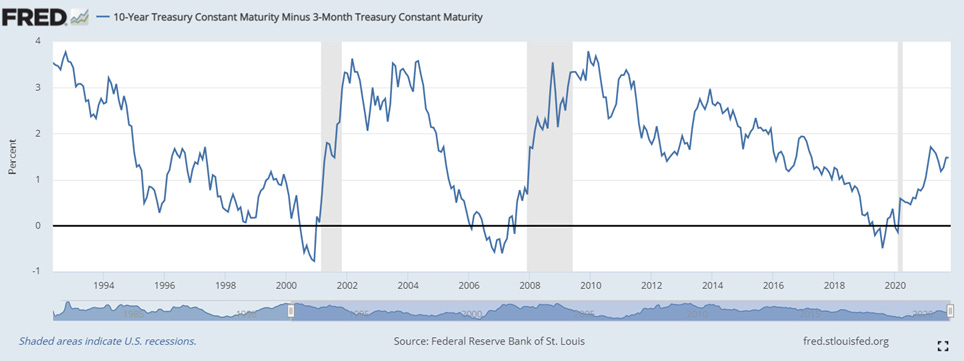

In the war against inflation, being slow to act is not a net benefit. Historically, delays in combating inflation necessitate larger, more dramatic efforts (mainly rate hikes) to be effective. Markets have already begun to anticipate this. Expectations of rate hikes have been pulled forward in the past few months and Taylor Rule modeling suggest rates as high as 6% might be required to bring rates back in line with inflation. As we discussed in our last issue (and as noted above) it is unlikely the global debt markets could tolerate a 10-year treasury rate above 2-3%, let alone 6%, given the record amounts of negative real-yielding debt that has been issued over the last 12 years (with a notable issuance binge in the last 12 months).

If the Federal Reserve does choose to act in the war against inflation, it is likely it will need to do so at a more aggressive pace than has been communicated. Any action to raise rates would likely put the global debt market and interconnected equity markets in significant peril.

The Enemy Gets a Vote:

Conversely, continuing to do nothing becomes an increasingly tenuous position for the Federal Reserve. As unpleasant as it might be, in life, we don’t get to wait until circumstances are perfect for us to act. (It is often the case that it is better to act fast and course correct along the way, although we appreciate that Federal Reserve action requires a certain level of deliberation.)

The Federal Reserve finds itself in this position. While awaiting for the perfect time to orchestrate a soft landing for an induced asset bubble, the economic situation has continued to grow more dire. As inflation has risen, growth has slumped and appears poised to drive the global economy back into recession. Under such circumstances, it is quite possible (perhaps even probable) that the Federal Reserve will need to tighten financial conditions (or at a minimum be unable to further loosen policy that is already stuck at ZIRP), while growth falters.

Said another way, the Federal Reserve may very well find itself in the position, where it is unable to act at the very moment the economy is in most need of monetary support.

In many ways, a deleveraging that results from market forces is far more dangerous than a Federal Reserve orchestrated deleveraging, since the former is likely to be effectively uncontrollable.

Actions Taken Abroad:

It is notable that faced with the choice between an uncontrolled deleveraging or a managed deleveraging, governments around the world have begun to take action.

China: China has begun a controlled deleveraging of it’s real estate and energy markets (two of the largest growth centers of the Chinese economy and also two of the most dangerously leveraged), amidst a larger regulatory crackdown (Beijing says it's time for companies to pay their overseas debts as Evergrande fears linger). The second order effects of slowing Chinese growth (a major contributor to global GDP and supply chains around the world) are already being felt and are likely to continue.

Australia: The Reserve Bank of Australia (RBA) declined to buy bonds in its regular market operations yesterday (27 October 2021), leading to speculation that the RBA will abandon its yield curve targeting policy (Australia's central bank declines to defend bond target even as yield spikes).

Canada: The Bank of Canada (BoC) announced yesterday (27 October 2021) that it will end its quantitative easing program, leading to speculation that the BoC is getting ready to raise benchmark rates (Bank of Canada ends QE bond buying program, a sign that higher rates are coming).

It is worth noting that these three nations (China, Australia and Canada) each have staggering amounts of household debt and massively inflated real estate markets (which echo the housing and financial crisis of 2007-2009).

Be On The Look-Out:

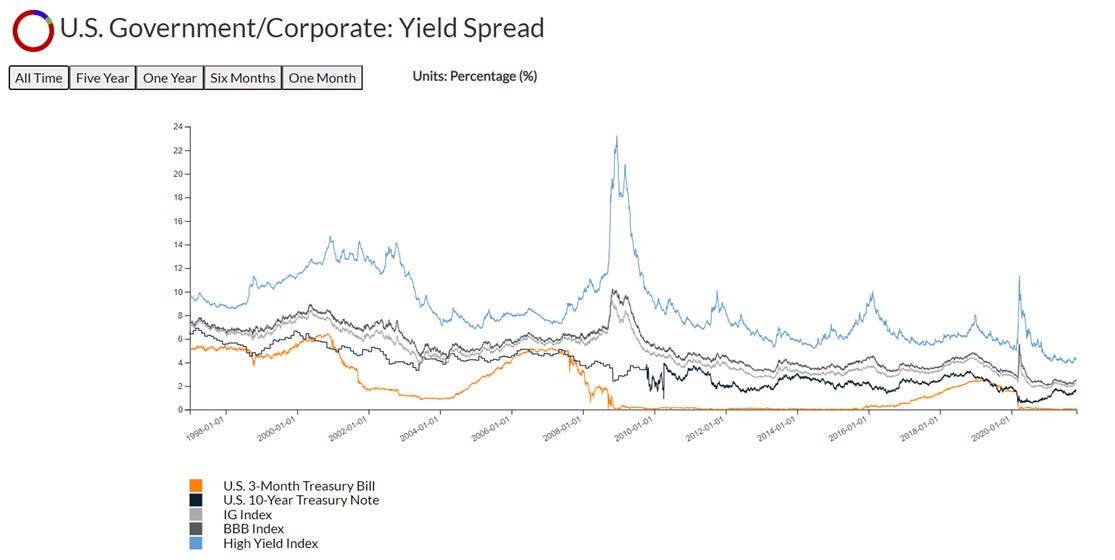

Given the foregoing, it is important to be on the look-out for any rapid deterioration in credit conditions (whether as a result of increases in interest rates or stifled growth), particularly from abroad, which could easily spill over into global markets.

(It is also worth noting that the Standing Repo Facilities and Reverse Repo Facilities should ease any dollar distress which may or may not result from deteriorating credit conditions, as discussed in our past issue.)

Economic Snapshot

GDP: Q3 $23,173.496 GDP growth decreased to a meager 2% owing in part to a lack of additional stimulus, inflationary pressures and supply chain disruptions. Notably the Atlanta Fed’s GDP Now forecast is appears poised to head back below 0.

Price: Stock market averages continue to remain at or near all-time highs with the S&P500 closing at 4,551.68 on October 27, 2021.

Price to GDP: Price to GDP ratios remain historically high with an S&P500 to GDP ratio of 0.2002. This exceeds the Price to GDP ratios seen during the Dot-com bubble.

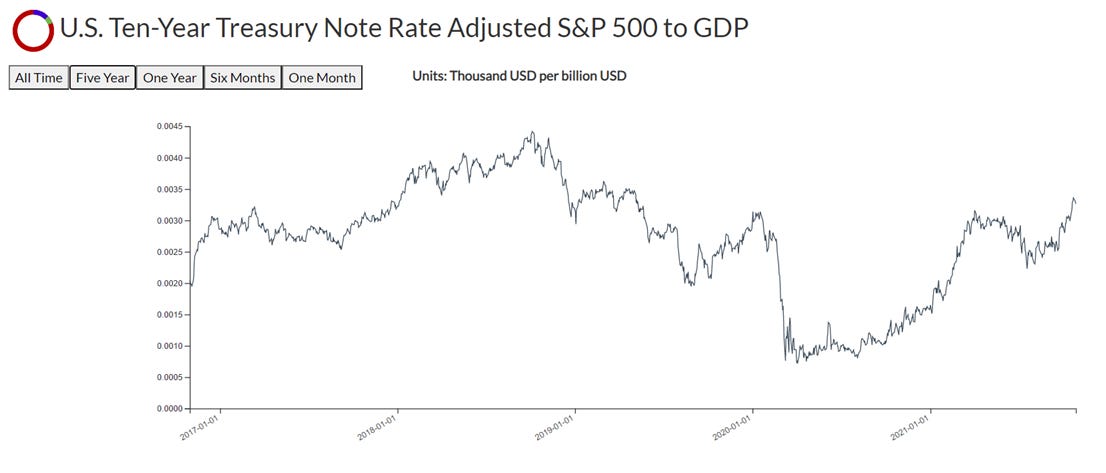

Interest Rates: The 10-Year Treasury Rate fell notably to 1.63 as of 26 October 2021.

Rate-adjusted Price to GDP: Rate-adjusted price to GDP has risen notably over the last few months (owing largely to an increase in interest rates and market prices).

Yield Spreads: Corporate credit spreads continue to remain at historic lows.

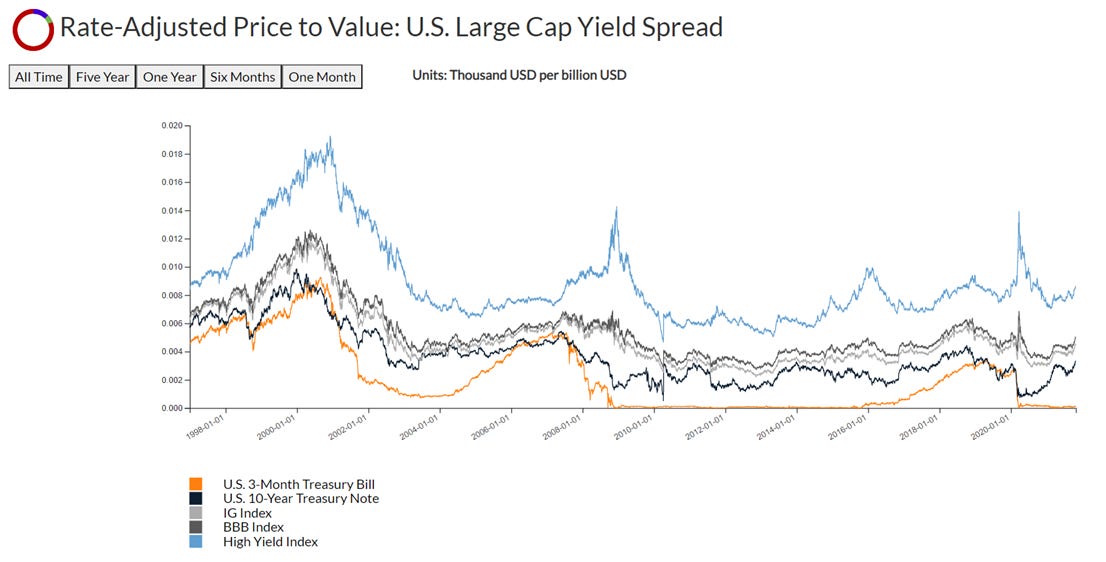

Yield-adjusted Price to GDP: Yield-adjusted Price to GDP has continued to rise moderately (owing largely to increases in asset prices).

10-Year to 3-Month Treasury Spread: The 10-year to 3-month treasury spread has increased to 1.48 as of 27 October 2021.

Disclaimer

The data displayed in this report was developed by DeCotiis Analytics LLC (“DeCotiis Analytics”) using various public sources. DeCotiis Analytics is NOT a registered investment adviser and does not guarantee the accuracy or completeness of the information contained herein, or any data or methodology either included herein or upon which it is based. Individual investment decisions are best made with the help of a professional investment adviser.

Although effort has been taken to provide reliable, useful information in this report, DeCotiis Analytics does not guarantee that the information is accurate, current or suitable for any particular purpose. Data contained in this report are those of DeCotiis Analytics currently and are subject to change without notice. DeCotiis Analytics makes no guarantee or warranty of the accuracy of source data or the results of compilation of such data.

The information provided herein is for informational and educational purposes only. It should not be considered financial advice. You should consult with a financial professional or other qualified professional to determine what may be best for your individual needs. DeCotiis Analytics does not make any guarantee or other promise that any results may be obtained from using the content herein. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, DeCotiis Analytics disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete, unreliable or result in any investment or other losses. Content contained or made available herein is not intended to and does not constitute investment advice and your use of the information or materials contained is at your own risk.

Information from this report may be used with proper attribution. All original text, graphs and compilations of data contained in this document are copyrighted material attributed to DeCotiis Analytics. Any reproduction or other unauthorized use of material herein is strictly prohibited without the express written permission of DeCotiis Analytics.